If you are thinking of applying for a mortgage you should first be aware that your lender will want to know a lot about you and what you are looking for.

This is all extremely justified, as a mortgage is likely to be the largest financial commitment you make in your life and therefore it makes sense for a lender to ensure you are creditworthy prior to lending you any money. This post will introduce you to the six areas a mortgage lender will want to know about.

Income and Employment

This should make a lot of sense – you are borrowing money and will need to make payments on a monthly basis. Therefore, your lender will want to make sure that your income is enough to cover these payments, as well as making sure that you have adequate income left over to live off.

Your employment will also be looked into - a lender will want to know how stable you are in your current job and therefore the likelihood that your current level of income will be sustained, if not improved upon. This is typically why many lenders will not provide mortgages for people who are still on a probationary period.

Debts

Your lender will want to know about your other debts, as this will impact on your potential ability to repay their debt. Basically, if you are already struggling with your outstanding debts, being late or missing payments, they are hardly likely to make the situation worse by lending you even more money.

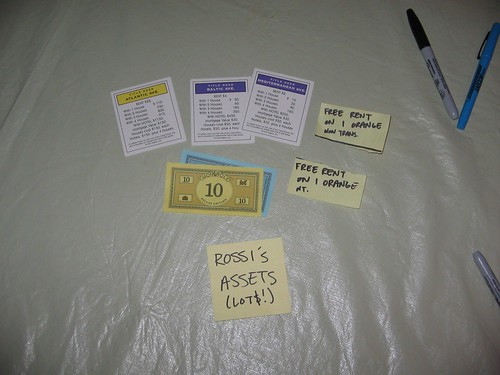

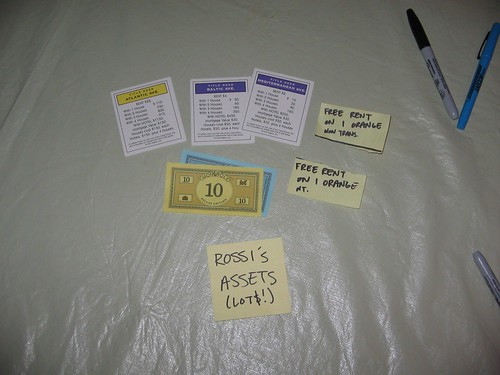

Assets

Not only will a lender look at your liabilities (debts) they will also want to know about your assets.

This may include other property or items of significant value, as well as any cash reserves you may have available. Once again, someone who has a number of assets is more likely to obtain a mortgage, as they are viewed as a far more secure option.

Down Payment

A lender will expect you to have a down payment, as in they are unlikely to lend you 100% of the property value in the form of a mortgage.

The more money as a down payment you have to put down, the more viable option you are as a mortgage borrower. It’s almost as though you are sharing the risk with the lender.

Purpose of the Loan

A lender will want to know if you require a loan for a residential property or for a commercial mortgage and whether you are looking to live or work there or possibly rent out the property.

All of these factors will influence their lending decision, the fees you will have to pay, and the type of mortgage product you can obtain. A prime example is that mortgage rates for investors are typically higher than for someone looking to reside in a property, as other factors such as tenants, repairs and maintenance, come into the equation.

The Type of Property and How You Will Use It

This was touched on above, but it makes a big difference to a lender the type of property you are looking to purchase and what you will use it for. Business mortgages are likely to be more expensive than a residential mortgage, as you will usually want to borrow a lot more money.A property located in a known flood region, which has been constructed from wood, may be far harder to obtain a mortgage on than a property in the same area that is constructed from concrete, etc.

Featured images:

License: Creative Commons

License: Creative Commons License: Creative Commons

License: Creative Commons License: Creative Commons

License: Creative Commons License: Creative Commons

License: Creative Commons License: Creative Commons

License: Creative Commons License: Creative Commons

License: Creative Commons

No comments:

Post a Comment

I love feedback, Please speak your mind. Spam comments will not be Published or will be deleted immediately, thanks.